- huaxiaostainless

- July 20, 2022

- 7:34 am

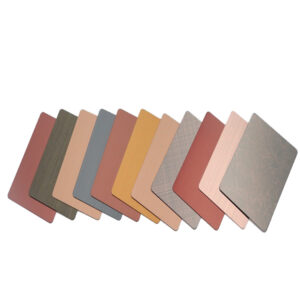

Mexico Launches ADD Investigation On Chinese Coated Steel

On June 2, 2022, the Mexican Ministry of Economy issued an announcement in the Official Gazette that, in response to the applications of Mexican companies Ternium México, S.A. de C.V., and Tenigal, S. de R.L. de C.V. Regional Coated Steel Sheet (Spanish: aceros planos recubiertos) initiates the first anti-dumping sunset review investigation, During the investigation period, the final ruling on June 5, 2017, and the anti-dumping measures determined by the announcement on November 21, 2017, continued to be effective.

The dumping investigation period, in this case, is from April 1, 2021, to March 31, 2022, and the damage investigation period is from April 1, 2017, to March 31, 2022. The TIGIE tax numbers of the products involved are 7210.30.02, 7210.41.01, 7210.41.99, 7210.49.99, 7210.61.01, 7210.70.02, 7212.20.03, 7212.30.03, 7212.40.04, 7225.91.01, 7225.9 , 9802.00.01, 9802.00.02, 9802.00.03, 9802.00.04, 9802.00.06, 9802.00.07, 9802.00.10, 9802.00.13, 9802.00.15, and 9802.00.19.

Stakeholders shall submit questionnaires, comments, and evidentiary materials within 28 working days after the announcement of the announcement.

On December 17, 2015, Mexico launched an anti-dumping investigation on coated steel plates originating in or imported from mainland China and Taiwan.

On June 5, 2017, the Ministry of Economy of Mexico issued an announcement in the official gazette, making final anti-dumping rulings on the products involved in mainland China and Taiwan, and deciding to levy ad valorem duties ranging from 22.22% to 76.33% on the products involved in mainland China. , imposing ad valorem duties ranging from 22.26% to 52.57% on the products involved in Taiwan, China.

On November 21, 2017, Mexico issued an announcement to adjust the anti-dumping duty of Baoshan Iron & Steel Co., Ltd. to US$0.1874/kg.

Chinese companies involved in the investigation are required to provide detailed information to defend their pricing strategies. On the other hand, Mexican companies are pushing for the extension of anti-dumping duties to stabilize market prices and protect domestic jobs.

The outcome of this case could have significant implications for international trade between China and Mexico. Should Mexico decide to impose tariffs on coated steel imports, the cost of Chinese steel could rise, forcing local businesses to explore alternative sources or face higher raw material costs.

This investigation is part of a broader global trend of countries scrutinizing Chinese steel imports, as nations seek to protect their domestic industries from aggressive pricing practices. The final ruling, expected in mid-2023, will determine the future of Chinese steel exports to Mexico and whether additional tariffs will be enforced.